Your Place to Find a Job

That's Entertainment

Veterans Wanted

Web Dev Rockstars

eCommerce Rising Stars

Great Universities

Construction Jobs

Working with the Elderly

Microsoft Stack Jobs

Career Changers

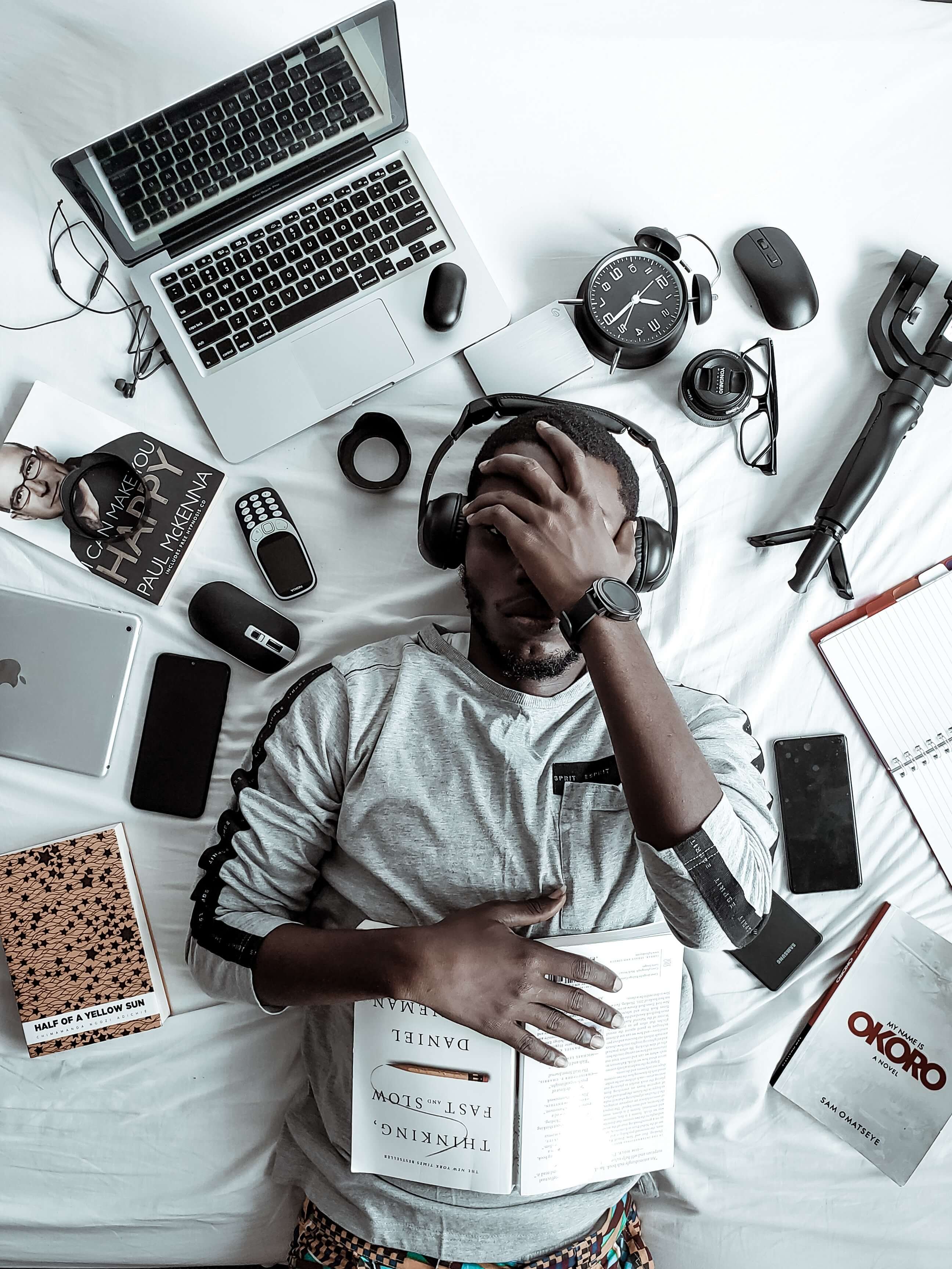

WFH Champions

Working with Kids

Top Hospitals

Keep on Truckin

Not For Profit

Healthcare Heroes

Mobile App Devs

Cloud Champions

Great Engineering Companies to Work For

Featured Employers

Explore companies

Lindsay manufactures and markets water management equipment and services including irrigation systems, pump stations, filtration, and M2M controls designed to increase or stabilize crop production whi... More

Metropolitan Utilities District (M.U.D.) is the only metropolitan utility district in the State of Nebraska. We are a public utility and are proud to be customer-owned. The District is governed by a b... More

Nebraska Children's Home Society is a nonprofit organization established in 1893, serving children and families throughout the state. We put "Children First," meaning that the chi... More

Newest Jobs

Browse all jobs

Visitation / Family Support Worker * $25-$28 / HR * Omaha Jobs

Licensed Nurse Practitioner - Omaha Licensed Nurse PractitionerJobs #Hiring #healthcare #Jobs

CLASS A CDL DRIVER - HEMINGFORD, NE

Member Service Representative

Field Sales Representative B2B - Allegheny PA #Hiring #Pennsylvania #Jobs

Operations Associate - Operations Administrative Assistant #Hiring #Jobs

Careerlink helped over 1 million people get the career they deserve

Get your dream job now.

Post your resumeI would not be in my current role without Careerlink. After separating from the military and moving to Omaha I tried all of the national online job sites to find a role that fit my unique experience and skill set. Either they provided me roles that did not match my background or my application got lost in the crowd. That was not the case with Careerlink

Bryce JohnsonThe Recommendation Process through Careerlink was simple, quick and made the difference! I believe it was that added edge I needed to not just get an interview, but land the job

Maris KingfisherGet inside our community

Learn. Connect. Explore. Join us for inspiring, innovative events, or keep up with current news and trends.

Turning Your Fans into Fantastic Employees: Introducing Careerlink Connect

In today's fast-paced business environment, finding the right talent is more crucial than ever. But how do you transform the casual visitor to your business into your next star employee? Enter Careerlink Connect, ...

Read on

Careerlink Salutes Veterans with New Features

Careerlink.com Launches New Veteran's Day Features to Boost Veteran Employment in Omaha Omaha, NE – November 9, 2023 – Careerlink.com, Omaha’s premier job-search platform, is excited to unveil ...

Read on

Top 5 Things HR People Never Say

We thought we would share a little bit of humor with you today, so here are a few things we've never heard HR folks say to us: 1. "I met my fiance making a reference check call." 2. "I like to unwind at the ...

Read onAbout Careerlink

Careerlink was founded as part of an Omaha, NE based nonprofit organization to offer jobseekers access to all of the best Omaha jobs. We now offer nationwide jobs on a platform featuring a complete applicant tracking system (ATS), mobile friendly experiences, AI based employee retention solution, innovations in recruiting and staffing, and job opportunities across all 50 States in a variety of industries and skill levels.

If you are finding yourself in a professional world of uncertainty amidst the many health and economic changes our world is going through right now, I recommend you lean into support from your family and friends, check out Careerlink, and know that we are all in this together

Brandi Holys